Election Expenses Toolkit

If you stand as a candidate in a local election or local by-election it is a legal requirement to submit a set of formal Candidate Election Expense Returns once the election is over. These returns detail the amount of money that has been been spent on the campaign during the regulated election period – and how that money has been used. They provide legal proof that the campaign did not incur costs in excess of the legal spending limit in the election.

Even if no expenditure was made during the campaign to promote a candidate – a set of expense forms still need to be submitted.

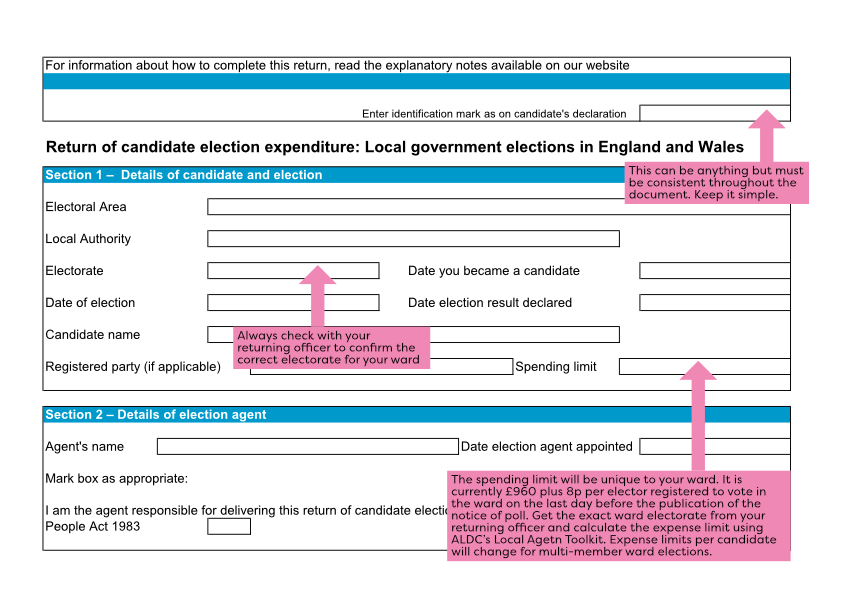

The current expense limit for local elections is £960 plus 8p per elector.

The below toolkit will help you fill out your expense returns by the legal deadline and is broken down into the following sections:

The Regulated Period

Your Election Expense return covers all spending used to promote the candidate during the regulated period of the election. This is the day after the date you officially become a candidate and ends on polling day – which for the 2025 Local Elections is 1 May.

The latest point for the notice of election being published for the 2025 local elections is Tuesday 25 March. You will become a candidate at midnight on this date if you, or someone else such as a member of staff or colleague, have declared your intention to stand – for instance on literature, in a press release, at a public meeting etc.

ALDC advise that you consider yourself a candidate from the earliest possible date – and record all spending thereafter in your expense return. This makes the process much simpler and protects against any challenge that might be made over when you were declared a candidate.

In the May 2025 Local Elections nominations close on Wednesday 2 April at 4pm. This is the latest date you can become a candidate however you should not leave it until the last day to submit your nomination paperwork.

Paperwork

Your Candidate Spending Return form must be printed and submitted physically. You cannot send it electronically.

- The formal Candidate Election Expense Return paperwork for England and Wales Principal Authority local elections can be downloaded from the Electoral Commission website here. An electronic version of the form can be downloaded here. When complete this would need to be printed and physically submitted.

- The formal Candidate Election Expense Return paperwork for Scotland Principal Authority local elections can be downloaded from the Electoral Commission website here. An electronic version of the form can be downloaded here. When complete this would need to be printed and physically submitted.

- English Parish and Town Council elections have distinct paperwork that can be downloaded here.

- Wales Community Council election expense returns can be downloaded here.

- Candidates and Agents will also need to submit declaration forms along with the expense forms for their ward. Please use these links to download your Candidates Declaration Form and Agents Declaration Form.

- Finally if a candidate incurred absolutely zero election spending, and received no donations, a Nil Expenses Return form must be submitted instead of an election expense return. A nil return form can be downloaded here. A slightly different form exists for Parish Council nil returns here.

Some Councils may issue older or slightly different forms. The legal requirement is that you submit your expenses and declarations, it is not specific on which forms or formats are used. If the forms in the examples that follow do not seem to match those you have been issued with by your council, you have two choices:

- Print off a set of forms from the Electoral Commissions website and follow these instructions. You do not have to use the forms the council give you.

- You could use forms issued by the council. However, you may have a problem matching the forms to the guidance. If you are confused by the forms being issued by your Council you can contact ALDC for advice.

Deadlines for Expense Returns

The deadline for submitting your Election Expense paperwork for the 2024 Local Elections changes slightly depending on the day in which the election result is declared, the whether you are standing in a Principal Authority election or a Town, Parish or Community Council election.

For all Principal Authority Elections in England, Scotland and Wales the deadline is always 35 days after the result is declared. So for example when looking at the 2025 local election timetable:

- If your result is declared on Thursday 1 May the deadline for returns is Thursday 5 June

- If your result is declared on Friday 2 May the deadline for returns is Friday 6 June

- If your result is declared between Saturday 3 and Monday 5 May the deadline for returns is Monday 9 June

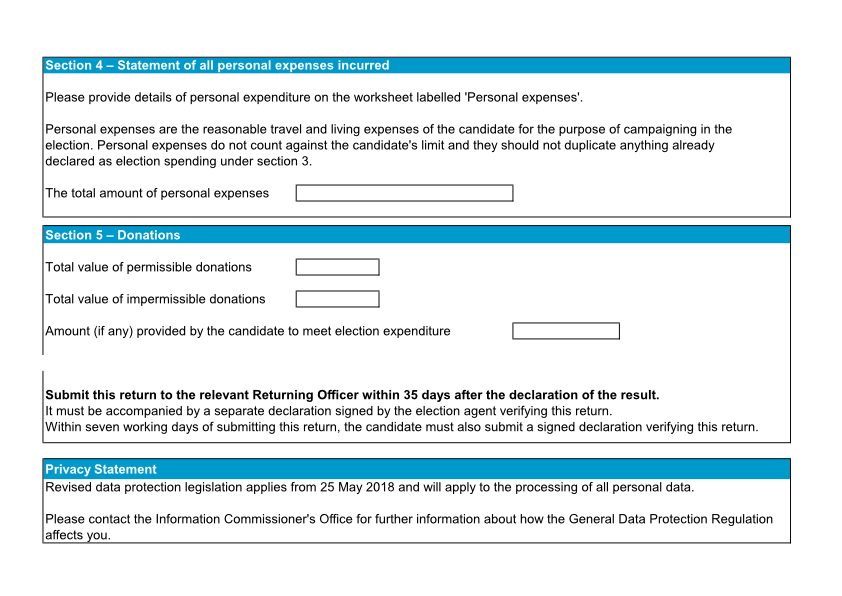

Within 7 days of submitting the expense return the Returning Officer must receive the candidate’s declaration form. It is best practice to just return this at the same time as your expenses.

Deadlines for Town, Parish and Community Council Candidate Expense Returns

The deadline for submitting expense returns for Parish, Town and Community Council elections is 28 days after the date of the election. So for the 2025 local elections this is Thursday 29 May.

Parish Council candidates are legally their own agent. It is still a legal necessity for Parish candidates to submit a set of expense returns. These returns must include any leaflet that promoted the Parish candidate – even if these were produced for principal authority elections occurring on the same day.

Running Through Your Expense Forms

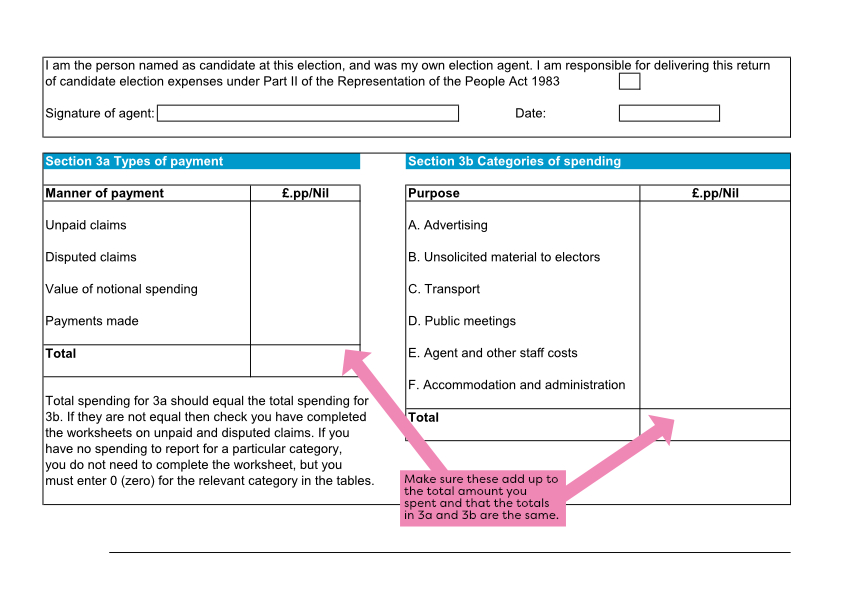

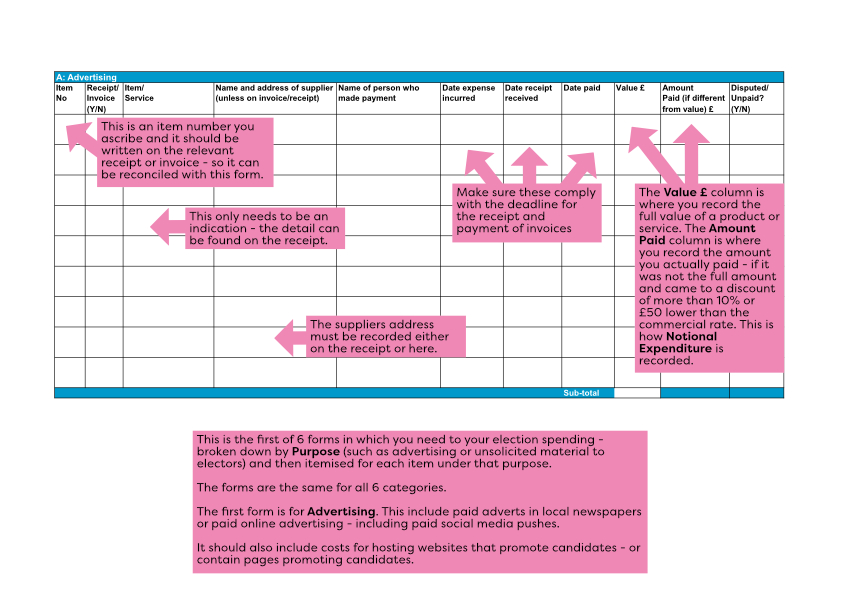

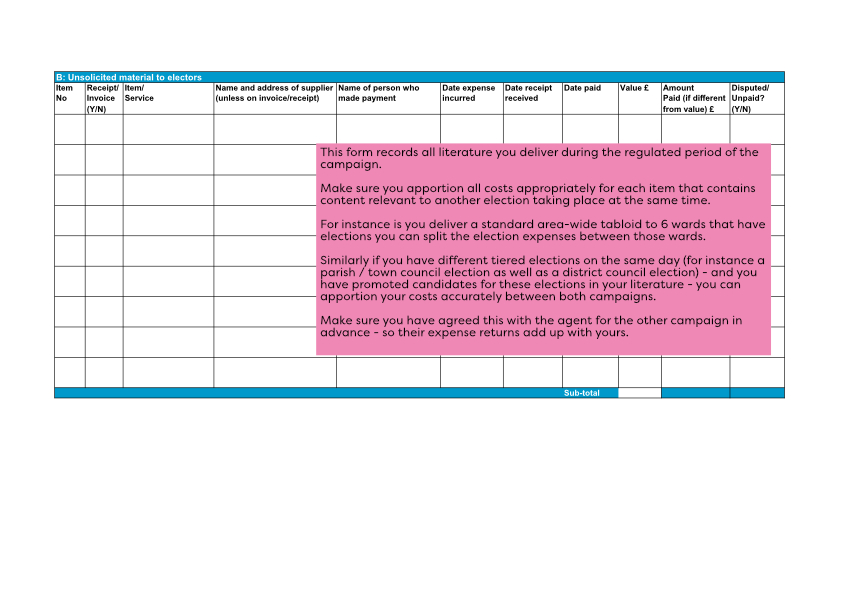

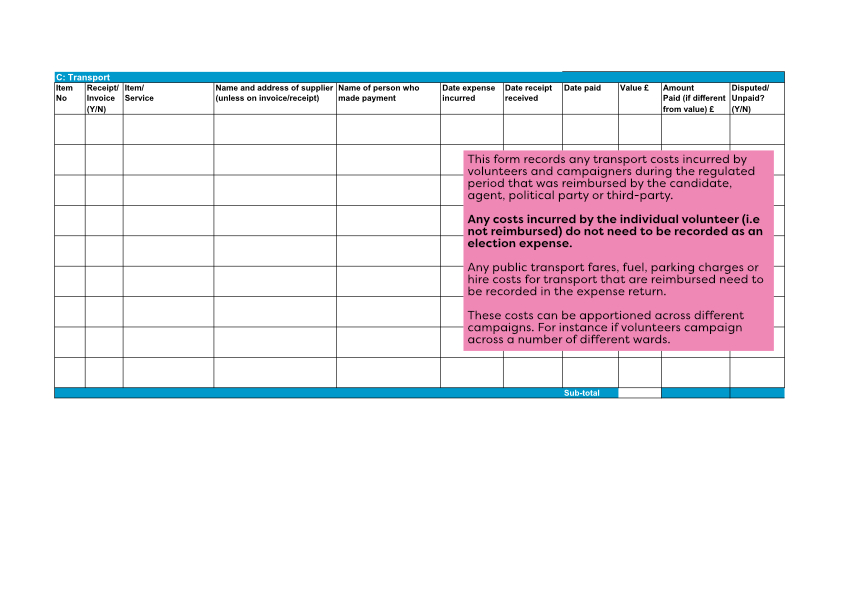

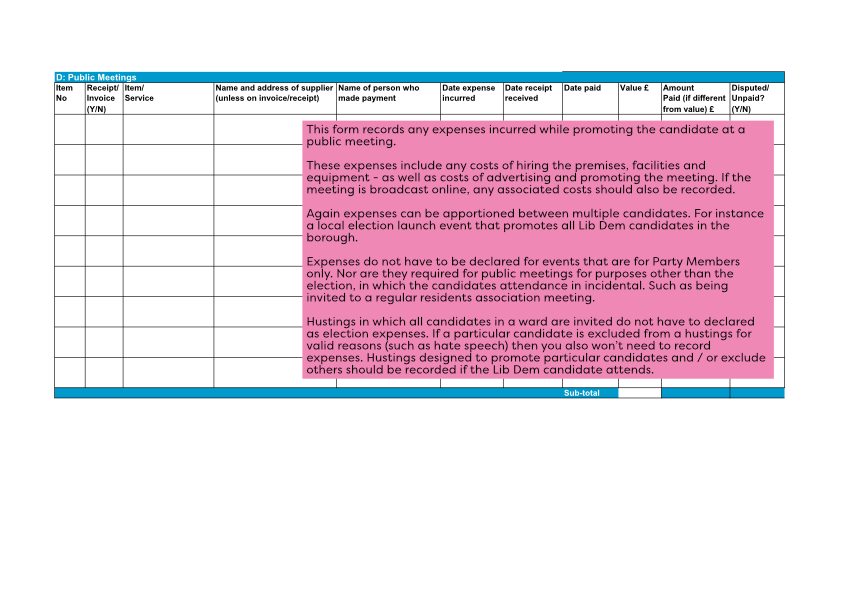

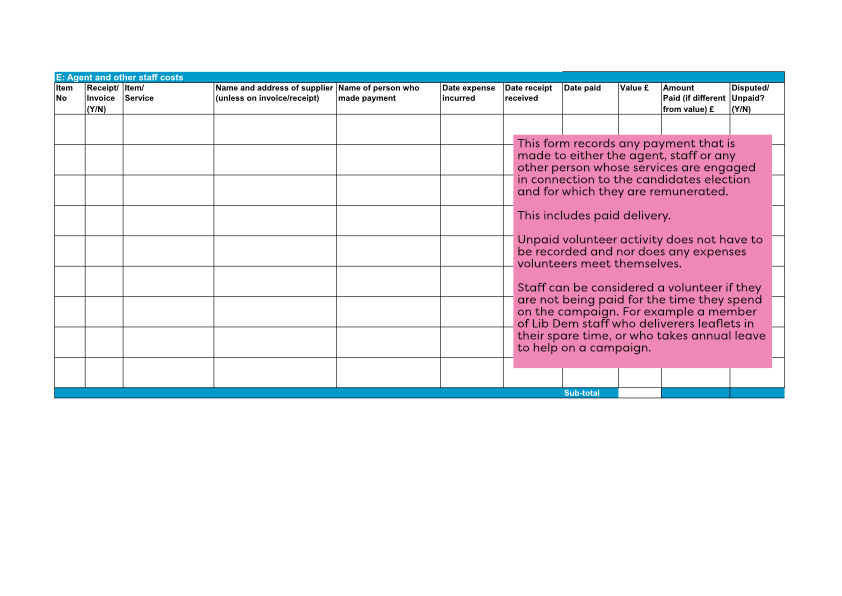

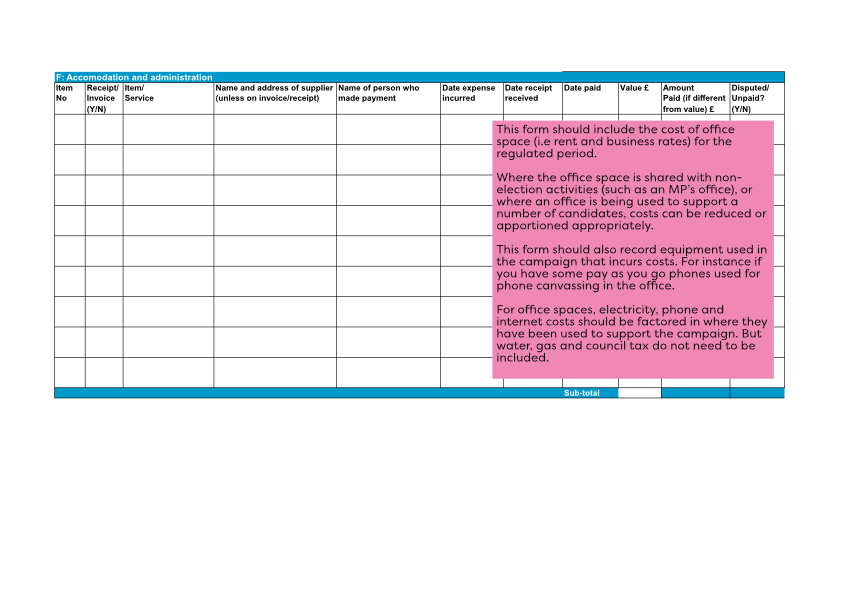

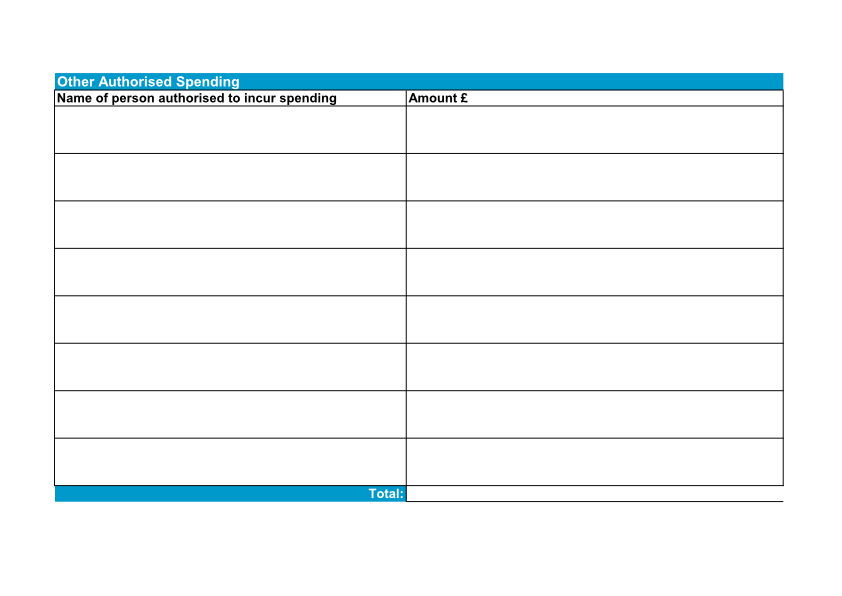

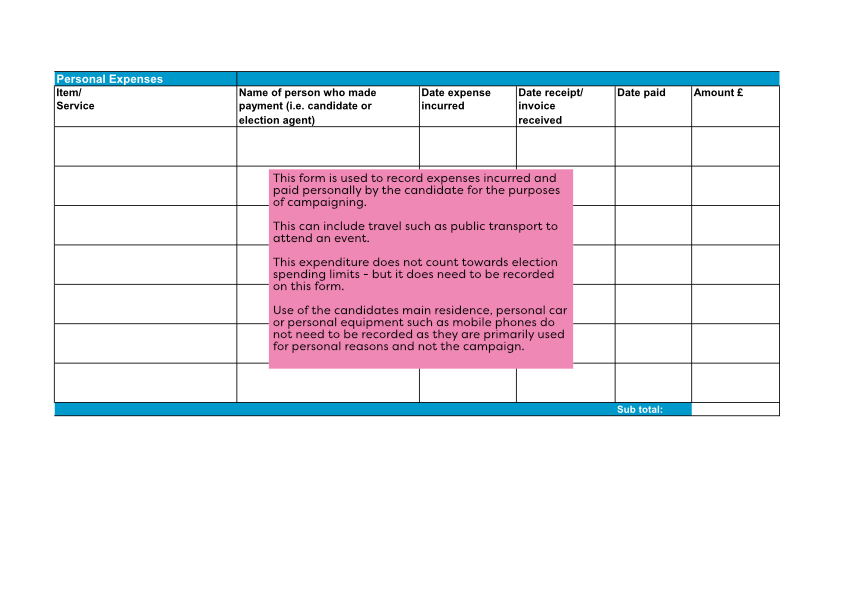

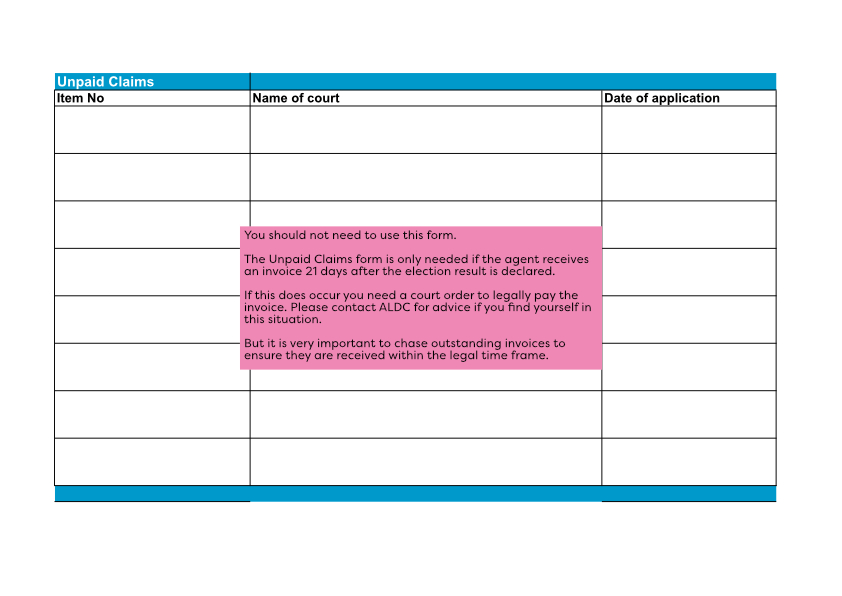

Below is a run through of the Election Expense forms with some notes to help you fill them out. The below forms are for Principal Authority elections in England and Wales. The forms for Scottish elections are identical and the same rules apply – however they are uniquely branded and you should use the Scottish forms for Scottish elections.

Parish, Town and Welsh Community Council elections have their own forms that look significantly different from the forms below. The spending limits and rules are the same but they are recorded differently on the forms.

You can download Parish and Community Council returns and guidance for completing them at the top of this toolkit.

You can find further guidance on how to declare your election spending in our Local Election Agents Toolkit.